Renters Can Save Money by Purchasing a Home

Exploding demand for rentals and a limited supply of available properties are leading to fierce competition and skyrocketing rental rates for tenants. The days of negotiating great rates with landlords are rapidly disappearing as more people enter the rental markets. And, the problem is expected to get much worse as the economy improves. Consider the following statistics according to Reis Inc.:

- Rental rates have increased 14% since 2010

- The average monthly rental payment nationally, is now $1,124.00.

- Monthly rates are expected to increase another 3.3% this year to $1,161.00

- Rental rates have been increasing at more than double the rate of home prices

Why has demand for rentals become so strong?

According to Zillow:

- Young people that have been living with their parents are moving out

- 32% of the adults in the U.S. were living with friends or family

- There are approximately 2.8 million people that have found jobs since last year

- Many workers who lost jobs and moved in with relatives are now finding jobs.

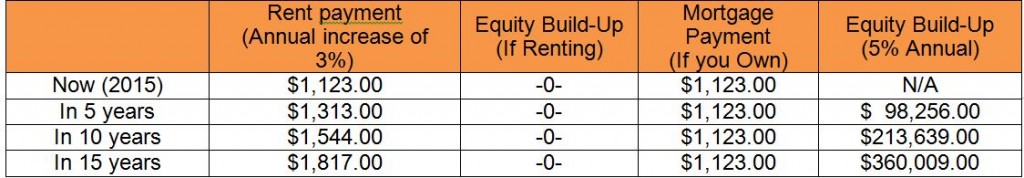

With the improving economy, the situation for renters is expected to get worse. Compare the long term impact of renting monthly, to buying a $242,000 home with 3% down on FHA financing, with a fixed rate of 4%, for a mortgage of $235,000. The Principal & Interest monthly payment is the same as the monthly payment for renting now: (Note: the additional expense for taxes and insurance is mostly offset by the tax savings enjoyed by homeowners that can deduct their mortgage interest payments from their federal income tax.

In the example above, a renter would have paid $242,219.00 in rent payments over the next 15 years, and HAVE NOTHING TO SHOW FOR IT! However, if the same person purchased a home today under the terms described above, they would have only paid $202,140.00 in mortgage payments,

(Far less than rental payments over the same period), but, in 15 years, would have $360,009.00 EQUITY IN THIER HOME!

You can pay yourself and secure your future, or you can pay your landlord’s mortgage and secure his or her financial security. It’s that simple!