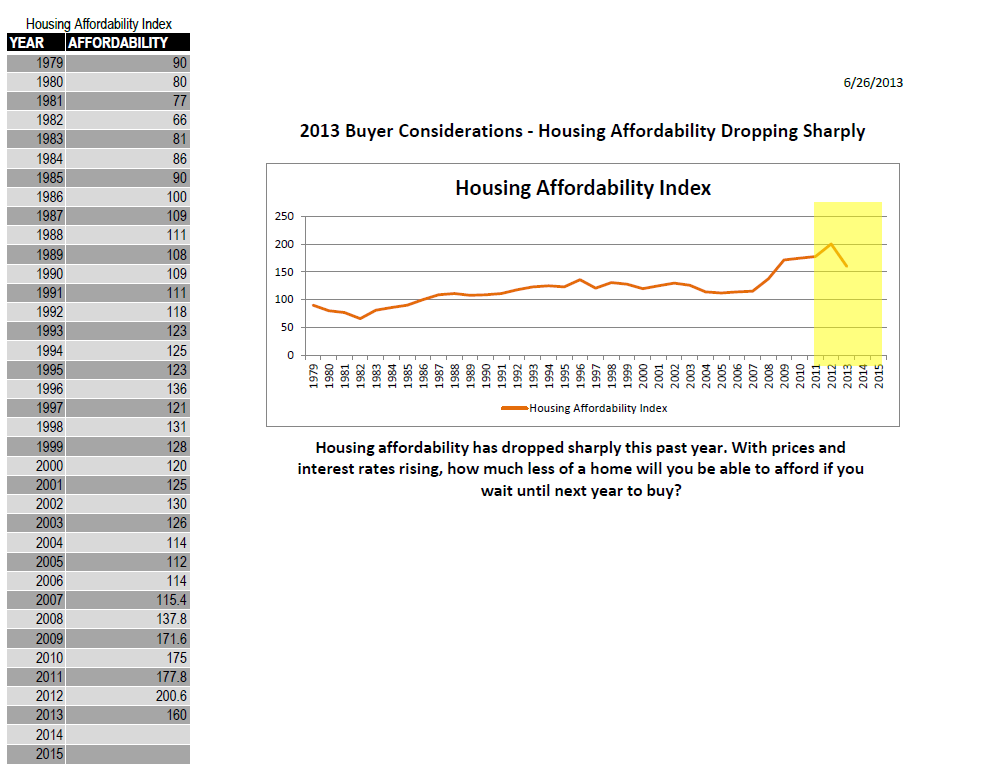

The National Association of Realtors has been tracking housing affordability for over 20 years. They consider three criteria in their affordability assessment: Income of the average American, the average price of a home in the U.S., the average 30-year fixed mortgage interest rate. As you can see from the chart below, the affordability for the past few years has been nearly double what it was for the prior 30 years. This means that buyers purchasing today are getting almost twice the home when compared to what home buyers in the past could afford. This is changing quickly, as prices and mortgage rates rise. If you’re thinking about buying a home, there may never be a better time than now!