When it comes to planning for retirement, our generation has been accused of being the worst in American history. Not only have baby-boomers neglected to set aside sufficient funds to ensure their later years are the “golden years”, most boomers haven’t even identified where they want to live when they retire. This lax attitude could have a devastating impact on the last 20, 30 or even 40 years of their life.

A good wealth management advisor can help you prepare financially for retirement, but when it comes to the emotional preparation for the golden years, you must recognize that your real estate portfolio can be an integral part of your happiness in later years. Why not address this issue right now, by buying the perfect home while prices and interest rates are still low. By financing the purchase of your dream retirement home now, you’re likely to save hundreds of thousands of dollars.

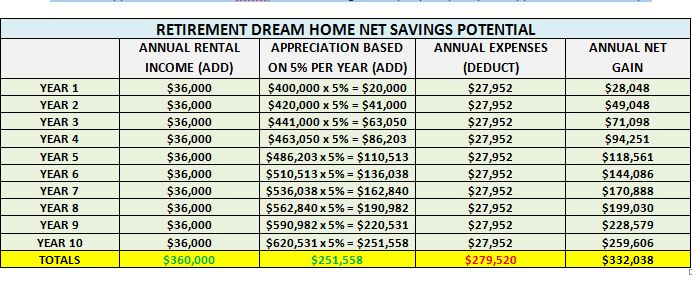

Consider the typical example below:

- You and your spouse are planning on retiring in 10 years.

- You have identified a dream retirement home in the perfect location in Florida that you can get for $400,000.

- You use funds from your 401k or other retirement account to come up with the down-payment of $80,000.

- You finance the balance of $320,000.00 at 4.5% over 30 years. The annual P& I = $19,452.

- Your taxes = $3,000 per year, insurance = $2,500 per year, and you put aside a reserve of approximately $3,000 per year for repairs & maintenance.

- You rent the home to a nice couple that has already retired (but can’t afford to buy a home because of poor planning), for $3,000 per month, or $36,000 per year.

- The home appreciates at the Case-Shiller national average of 5% per year. (Last year’s appreciation was 12.2%).

When you’re ready to retire and move to Florida, you can pay the mortgage off from the appreciated value of your primary residence, and put the remaining balance into your retirement account. By purchasing your dream retirement home now at today’s low prices, at retirement, that home could be worth over $650,000. If you don’t use this strategy, the dream home you could have purchased may be too expensive, and you’ll have to spend your retirement years in a home you “settled” for.