Never Stop Closing Your Buyers Agents continue to search in vain for a magic formula to get buyers to buy now. The bad news is, there’s no such thing as a magic pill. Agents must earn their money by using spaced repetition to get buyers off the fence. The good news is most buyers will […]

Understanding Recaptured Appreciation

Understanding Recaptured Appreciation One of the most compelling reasons to buy real estate now is the opportunity for short term appreciation growth due to the overcorrection of real estate prices. Just as there was no valid justification for 20% annual appreciation growth in 2004 and 2005, there is also no valid reason for the excessive […]

The New American Dream – Rent!

The New American Dream—Rent! In the Christmas favorite “It’s a Wonderful Life”, George Bailey’s building and loan is the only thing stopping greedy Mr. Potter and his bank from turning Bedford Falls into a rent district. How appropriate a scenario for what’s happening today with home ownership? Since 2004, home ownership in the United States […]

Buyer Considerations- Stock Market Vs. Real Estate

Top 10 Buyer Considerations for 2011

Many experts believe there may never be a better time to buy a home. There is mounting evidence that “The Best Selection of Homes at The Best Prices”, is rapidly becoming a thing of the past. Here are the most important considerations for buyers: Top 10 Buyer Considerations for 2011 1. Emotional Appeal – It has […]

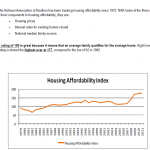

Buyer Considerations-Housing Affordability Index

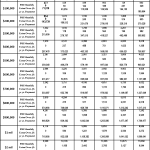

Buyer Considerations-Mortgage Interest Rate Savings Chart

If a homeowner kept their home with a $500,000 mortgage for 30 years, but waited to buy after rates went to 10%, they would pay the bank an extra $1,704 each month or $1,704/month × 360 months = $613,440. Why pay the bank extra?

The History of Interest Rates

THE HISTORY OF INTEREST RATES 1. For nearly 30 years, the interest rate averaged around 7.5%-8.0%. But, with the Fed Policy of Quantitative easing, the rates have been artificially low at around 4%. 2. With the Fed modifying it’s policy, nearly every expert agrees rates will increase. Many experts expect rates to return to the 7.5%-8% in the near […]

Don’t Make Banks Your Private Charity

Don’t Make Banks Your Private Charity All buyers, even investors, should consider the interest rate issue: 5.2% April 2011 9.2% 2014? 7.2% 2012? 4.2% Dec 2010 For every 1% interest rates increase, it costs borrowers approximately $0.60 per month for every $1000 they finance. Formula = $0.60/$1000/month/1% This doesn’t sound like […]

Expect Prices to Rise, An Absolute Indicator

Expect Prices to Rise, An Absolute Indicator Warren Buffet has stated that it’s very difficult to invest at the bottom of the market, because you don’t know what the bottom is until it passes. His strategy has always been to invest when data indicates a market is “at or near the bottom” and is likely […]