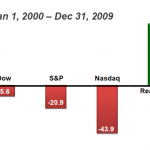

This is another good one for you to send to buyers… Where Should You Put Your Money? How does the return on real estate compare to the return from stocks since January 1, 2001? Real estate has appreciated 45% without recovering yet. Dow is up 5.8%. S&P is down 12%. NASDAQ is down 34%. […]

February’s Housing Stats Show No Recovery Yet

February’s Housing Stats Show No Recovery Yet New and existing housing once again posted records for poor performance. Consider these key facts as reported by the Commerce Department this week for February: Existing Home Sales: Dropped 9.6% to a seasonally adjusted 4.88 million units, from last month. Dropped 2.8% from February 2010. Median price […]

Tell Washington We’re Drowning

This is “food” for thought… Tell Washington We’re Drowning While Wall Street, Corporations and the Banking Industry have recently enjoyed record profits and significant progress towards a complete recovery, the average American is struggling to make ends meet. Consider the following: Housing Costs – According to Loan Processing Services Corporation, 87% of the homeowners […]

The History of Interest Rates

THE HISTORY OF INTEREST RATES 1. For nearly 30 years, the interest rate averaged around 7.5%-8.0%. But, with the Fed Policy of Quantitative easing, the rates have been artificially low at around 4%. 2. With the Fed modifying it’s policy, nearly every expert agrees rates will increase. Many experts expect rates to return to the 7.5%-8% in the near […]

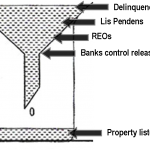

Bank Foreclosure Funnel

BANK FORECLOSURE FUNNEL The funnel above shows the difficult situation for banks. They have an overabundance of delinquent homeowners, Lis Pendens that have been filed, and REO properties they are holding. So, why don’t they step up each phase of the foreclosure process and wipe out the bad debt? Because dumping all of this […]

Are Responsible Home Owners with Great Credit Being Cheated?

Are Responsible Home Owners with Great Credit Being Cheated? Consider the following Scenario: The Bigheads live next door to the Frugals. They’ve been friends for many years and purchased their identical homes at the same price, next to each other in 2006. They even used the same bank to finance their purchases at 7.2% interest […]

Never Rent! Let Uncle Sam Help Pay for Your House

Never Rent! Let Uncle Sam Help Pay for Your House One of the most revered “Sacred Cows” in the Tax Code is the deduction that Homeowner’s are allowed to take for the mortgage interest and property tax expenses they pay on their primary residence. Homeowners are allowed to write off mortgage interest and property taxes […]

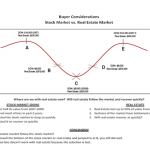

Will the Real Estate Market Follow the Stock Market?

Will the Real Estate Market Follow the Stock Market? The Stock Market has experienced dramatic swings in value during the past four years. After reaching a high of approximately 14,000 in 2007, values plummeted to about 6,500 in 2009. During the last 24 months, the Dow has regained most of the value it had lost. […]

Understanding Job Statistics

UNDERSTANDING JOB STATISTICS THE REAL PICTURE IS MURKY We’re beginning to see signs of a definite trend developing in the labor markets. The January employment rate as reported by the Bureau of Labor Statistics shows non-farm payrolls for the month were up 36,000; The increase was projected to be 146,000; the 110,000 difference was likely […]

Between A Rock and A Hard Place? There is Hope.

Between A Rock and A Hard Place? There is Hope. It’s virtually impossible for a homeowner who’s behind in mortgage payments or is underwater (owes more than what their home is worth), to solve the problem by themselves. Take a look at the five scenarios below to see how dangerous this can be for a […]