Economic Considerations – Foreclosures Are Still Impacting Prices

It’s a well-known fact that foreclosures and short-sales have a direct impact on housing prices, as distressed property sales average 20% less in price than sales of non-distressed properties. Normal price appreciation isn’t likely to occur until foreclosure rates return to their historical averages, and that may take a while.

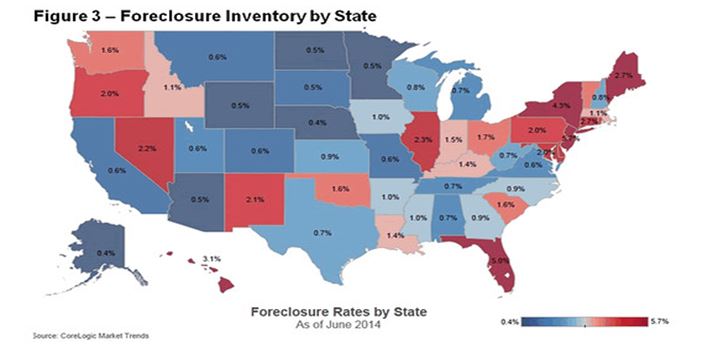

According to Mark Fleming, chief economist at Corelogic, the foreclosure rate is still 4x higher than it was in the early 2000’s, this despite the fact that the inventory of foreclosed homes has now dropped for 32 consecutive months. The good news is the 648,000 homes presently in some stage of foreclosure, represent a 35% drop from June of last year, according to Corelogic.

It may take longer for the hardest hit states to return to normal. They include New Jersey at 5.7%, and Florida at 5%. Once the overhang of foreclosures is normalized, price appreciation could become more significant, especially with mortgage rates, household formations and new home construction costs increasing.